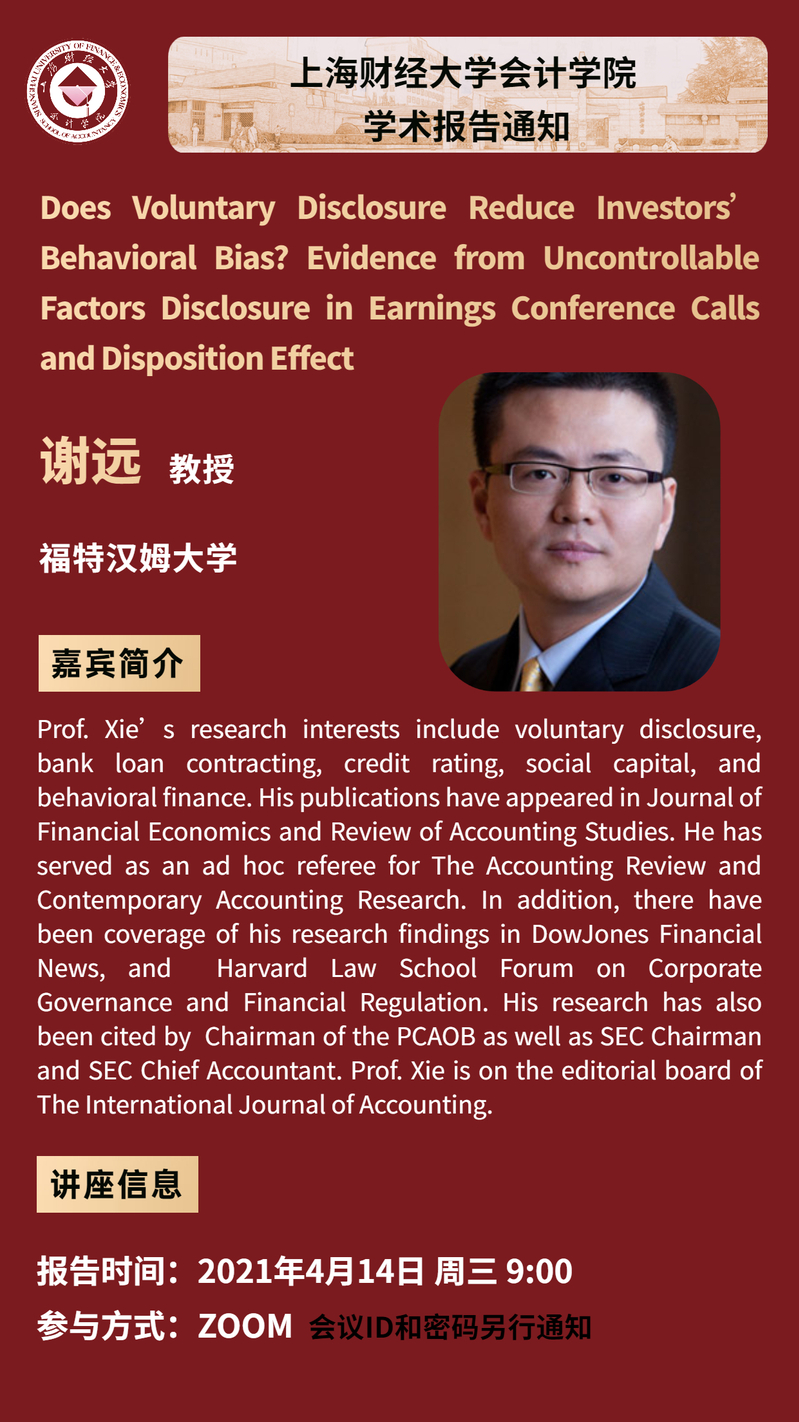

【报告主题】Does Voluntary Disclosure Reduce Investors’ Behavioral Bias? Evidence from Uncontrollable Factors Disclosure in Earnings Conference Calls and Disposition Effect

【主讲嘉宾】福特汉姆大学 谢远

【报告时间】2021年4月14日 9:00

【参与方式】ZOOM

【内容提要】We hypothesize and find that voluntary disclosure of attributing bad news to uncontrollable factors in earnings conference calls helps investors resolve cognitive dissonance, and thus they display a reserve-disposition effect (Chang, Solomon, and Westerfield 2016). Specifically, when firms disclose uncontrollable factors (UFD) as the reasons for negative earnings surprises, we show that short-window stock return around earnings announcement (EA) is more negative, while long-run drift is less pronounced. We also find that firms dominated by retail investors and net-selling of retail investors around EA drive our results. Finally, we propose a few possible alternative explanations including information asymmetry reduction, increase in information uncertainty, information leakage, earnings persistence, and managers’ self-serving disclosures, then rule them out one-by-one. Our inferences stay the same when using alternative measure of reference price to gauge disposition effect following Grinblatt and Han (2005) and propensity score matching. Collectively, this paper contributes to the accounting literature by showing that UFD reduces the disposition effect (an important behavioral bias) by helping investors overcome loss aversion and respond to bad news more efficiently. In addition, our evidence also adds to the finance literature by documenting when investors blame the scapegoat (uncontrollable factors), a reverse-disposition effect exists in non-delegated assets such as stocks.

TOP

TOP