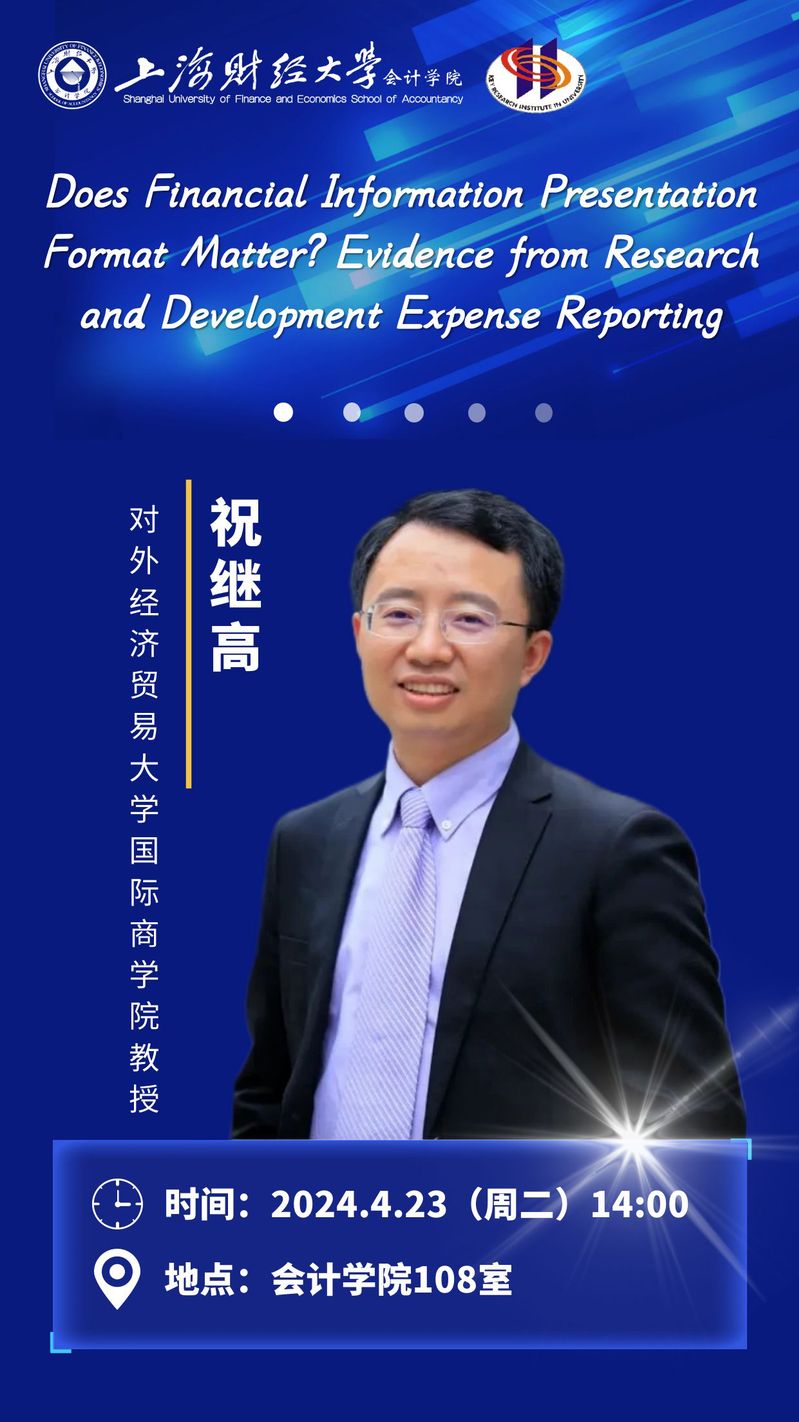

【讲座时间】2024年4月23日 14:00

【讲座地点】会计学院108室

【讲座主题】Does Financial Information Presentation Format Matter? Evidence from Research and Development Expense Reporting

【嘉宾介绍】祝继高,对外经济贸易大学国际商学院教授

对外经济贸易大学国际商学院副院长、教授、博士生导师,入选国家级人才计划和财政部全国高端会计人才(学术类)。主持国家社科基金重大项目、国家自然科学基金面上项目和青年项目等多项国家级课题。主要研究领域为公司财务、会计信息与资本市场、“一带一路”倡议与企业投融资,在《经济研究》、《管理世界》、Journal of Corporate Finance、Journal of Banking & Finance等国内外重要期刊发表论文40余篇。荣获2021年北京市高等教育教学成果奖二等奖、北京市第十六届哲学社会科学优秀成果奖二等奖等多项省部级教学和科研成果奖励。

【内容提要】

This paper investigates the real and capital market effects of a mandatory change in the presentation format of research and development (R&D) expense. We utilize a setting of China’s implementation of a new presentation format of corporate R&D expense that requires Chinese public firms to present their R&D expense on their income statements as a separate line item (income statement presentation), instead of as part of the general and administrative expenses supplemented by additional information in the notes to the financial statements (footnote presentation). We predict that this regulatory change will have a bigger impact on non-state-owned enterprises (non-SOEs) which are focused on their stock market valuation than state-owned enterprises (SOEs). Using a difference-in-differences approach, we find that non-SOEs report significantly higher R&D expense in the income statement presentation regime. Furthermore, the effect of the presentation format on reported R&D expense is more pronounced for firms facing higher peer pressure to engage in R&D and hi-tech firms, and less pronounced for firms with higher institutional investment. We also find that the positive valuation implication of reported R&D expense diminishes after the presentation format change, suggesting that the markets potentially discount the increase in R&D expense.Additional analysis shows that firms’ innovation efficiency decreases post-regulation. Our findings suggest that new R&D expense regulation may have incentivized firms to either misclassify other expenses as R&D or invest in lower quality R&D. However, the stock market rationally discounts the increased R&D with lower valuation.

TOP

TOP