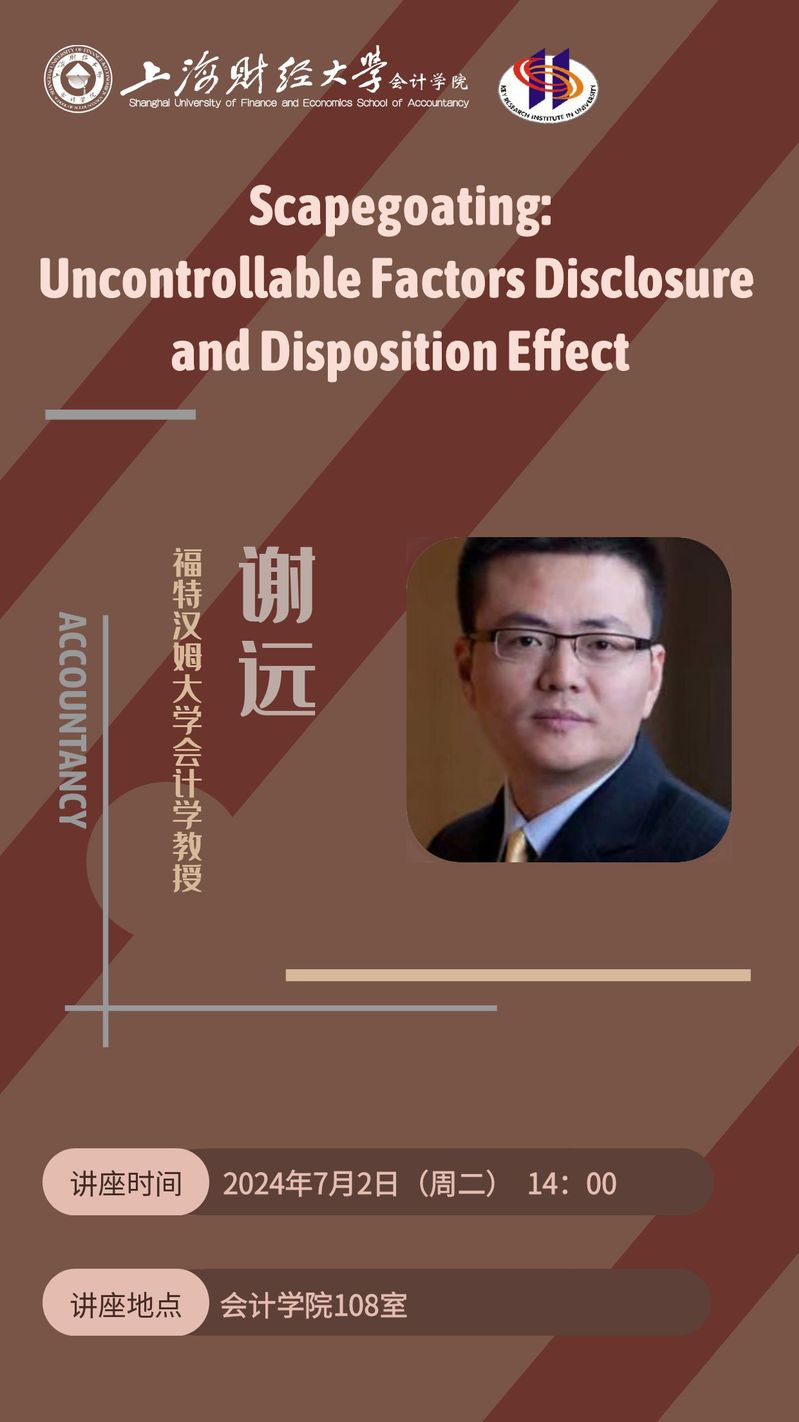

【讲座时间】2024年7月2日 14:00

【讲座地点】会计学院108室

【讲座主题】Scapegoating:Uncontrollable Factors Disclosure and Disposition Effect

【嘉宾介绍】谢远,福特汉姆大学会计学教授

Yuan Xie is James Roosevelt Bayley Distinguished Professor of Business at Gabelli School of Business, Fordham University. Prof. Xie's recent research focuses on voluntary disclosure, behavioral finance, and labor markets. His research has been covered by Dow Jones Financial News and Harvard Law School Forum on Corporate Governance and Financial Regulation, as well as cited by SEC Chairman, SEC Chief Accountant and PCAOB Chairman. Prof. Xie is an editorial board member at Journal of Accounting, Auditing and Finance.

【内容提要】

Our hypothesis is that the disposition effect - the tendency to sell winners but hold on to losers - is weaker when investors can attribute their losses to forces beyond their control. We test this hypothesis in the disclosure setting that uncontrollable factor disclosure (UFD) in earnings conference calls serves as a scapegoat. Our results suggest that when a firm with paper loss discloses more uncontrollable factors, its long-run return drift after the earnings call is weakened. This is attributable to the greater sales than purchases by retail investors in the short window immediately after the earnings call. Additional analyses using StockTwits data reinforce these inferences. Our findings are robust to using natural disasters as an instrument for related UFD, falsification tests, and a battery of sensitivity analyses. Collectively, the study’s findings highlight the importance of firm disclosure in counteracting investors’ cognitive bias and improving price efficiency.

TOP

TOP