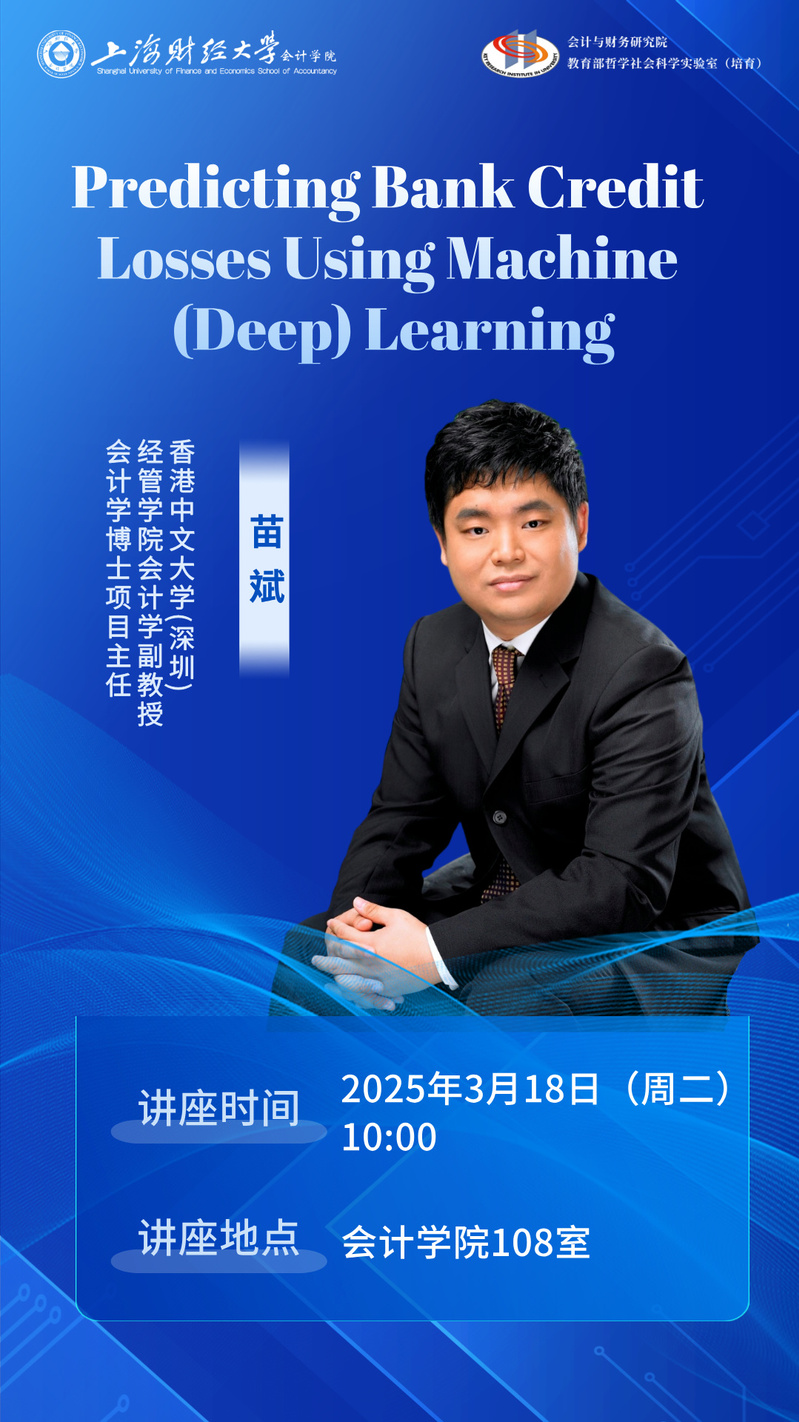

【讲座时间】2025年3月18日 10:00

【讲座地点】会计学院108室

【讲座主题】Predicting Bank Credit Losses Using Machine (Deep) Learning

【嘉宾介绍】苗斌,香港中文大学(深圳)经管学院会计学副教授、会计学博士项目主任

苗斌博士现任香港中文大学(深圳)经管学院会计学副教授。在加入港中大深圳之前,他曾在香港理工大学和新加坡国立大学任教,并曾在新加坡特许会计师协会担任研究主管。他的研究领域主要包括公司信息披露,实证资产定价,市场微观结构,并专注于研究会计信息对股票价格的影响。其研究成果曾在Journal of Accounting Research, Journal of Accounting and Economics, The Accounting Review和Review of Accounting Studies等顶尖会计学期刊上发表。

苗斌博士2003年本科毕业于天津大学工商管理系,之后于2007年在南洋理工大学获得会计学博士学位。他同时还是特许金融分析师(CFA)持证人。

【内容提要】

The transition in banks’ loan loss accounting from the incurred loss model to the expected loss model (CECL) requires a forward-looking approach to estimating credit losses over the lifetime of loans. Developing reliable long-term credit loss predictions presents a significant challenge due to the inherent uncertainty in future economic conditions. This study applies deep learning methods to long-term bank credit loss prediction and evaluates their performance against existing linear models. Our findings show that Long Short-Term Memory (LSTM) networks and Feature Tokenizer Transformer (FT-Transformer) significantly improve predictive accuracy, particularly in capturing long-term dependencies. In contrast, decision-tree-based models offer no advantage over linear methods. The predictive gains of deep learning models are strongest in longer-term forecasts, financial crises, and banks with heterogeneous loan portfolios. Using explainable AI techniques, we find that the relative importance of real GDP increases with the forecasting horizon, while the significance of current net charge-offs declines. Finally, our results suggest that CECL provisions may help reduce the procyclicality of bank lending, offering valuable insights for financial institutions, regulators, and investors.

TOP

TOP